Introduction

It is well known that cryptocurrency mining and trading can be highly profitable. But given the volatility of the crypto, most of the traders are often looking for other ways to leverage their participation in this ecosystem, and one of them is mining. However, with the volatile nature of the crypto market and the rising competition in mining, the profitability of crypto mining has become a subject of debate. In this article, we will examine whether crypto mining is still profitable in 2023 and factors that can influence its returns.

Just consider Bitcoin. In the beginning, bitcoin miners only needed a computer and an internet connection, and voila: hundreds or even thousands of BTC could be mined from the comfort of a miner’s home without any special equipment. Today, bitcoin miners need expensive mining rigs and graphics processing units (GPUs), a low-cost power source, mining software, and even hardware. membership in a mining network.

Cryptocurrency Mining

Mining takes place on the blockchain, a process that creates new units of a virtual token, which then enter into circulation in the market. Cryptocurrency mining also describes how transactions are confirmed on the network and is an essential part of blockchain operations.

A blockchain is a decentralized network of computers run by individuals (miners) around the world. It takes its name from its description as a series of linked blocks. Each time a transaction takes place, the corresponding data is stored on a block. As stated earlier, miners are responsible for validating blockchain–based operations and do so with special hardware.

Miners race to be the first to complete a complex mathematical puzzle generated by the network. Whoever “wins” the race successfully approves a block of transactions, and in the case of BTC mining, they are rewarded in bitcoins.

Is Crypto Mining Still Profitable?

Bitcoin mining has changed from what it once was. It’s dangerous, uses a lot of energy, and calls for strong, specialized machinery. Despite all of this, mining continues to be attractive to many people as a potential venture.

Profiting from bitcoin mining is still entirely feasible. Your level of investment and a little amount of luck will determine whether it is profitable for you. The blockchain will continue to be built by miners for many years to come. So, if you believe mining bitcoins is for you, you shall get started right away.

Mining – What Does it Involve?

High-performance equipment

Almost everyone could mine bitcoins soon after they were created.

But today, BTC is significantly more competitive, and the quality of your equipment plays an important role in determining whether or not mining is profitable for you.

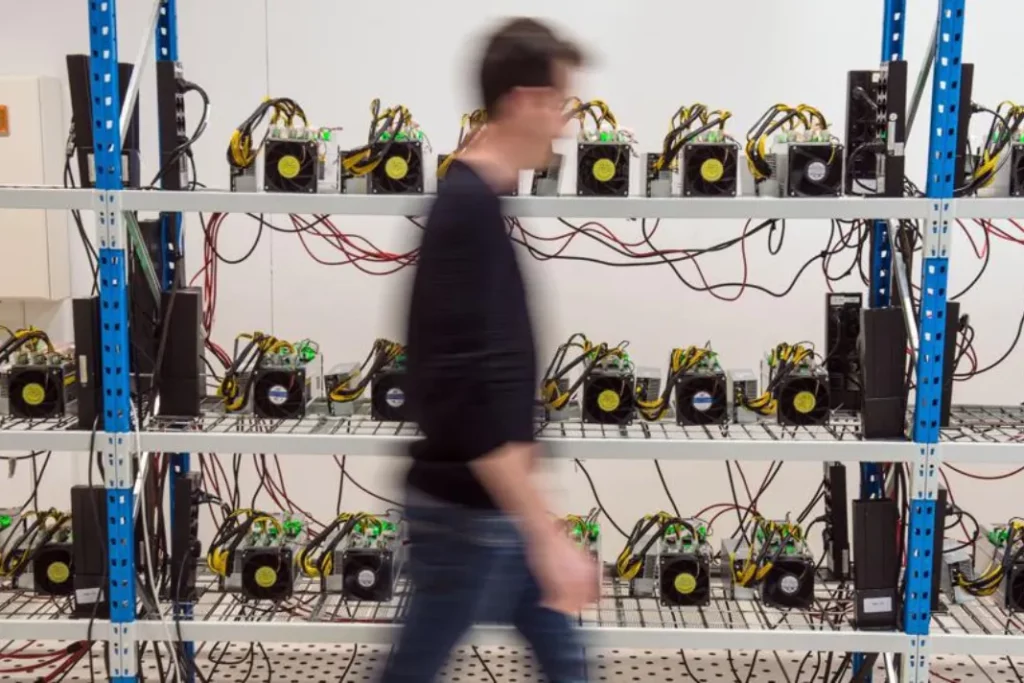

Thousands of miners are vying for the same gains simultaneously and inefficient hardware disadvantages individuals. The mining process requires a large amount of computing power, and there is very expensive specialized hardware to handle these calculations.

Energy Costs

Another important element to consider is the energy efficiency of the equipment. The mining process consumes a lot of energy and it is essential to have hardware that helps you reduce your energy consumption. Quality hardware is non–negotiable if you intend to set up a profitable mining rig.

Mining is an incentive activity, but the earnings must cover the costs of the process, and the electricity bill is one of them.

The Reward Block and The Mining Difficulty

The hash rate is the measure of how difficult it is to mine a cryptocurrency: a higher hash rate indicates that it will take more computing power to earn the same amount of tokens. This, therefore, means that it will be much more difficult for a lone miner to make a profit. At the same time, the block reward for most digital currencies is halved at a set frequency until the project reaches the maximum amount of coins.

The Choice of Tokens

The revenue from mining also varies depending on the coin you have chosen to mine. There is a wide range of alternative currencies (“altcoins”) to BTC, including Monero (XMR), litecoin (LTC), Ethereum Classic (ETC), Zcash (ZEC), Bitcoin Gold (BTG), and Dash (DASH).

You can use a cryptocurrency profitability calculator to estimate the potential mining gains of most tokens. The site WhatToMine, for example, lists several tokens that offer daily earnings of 0.50 to 1 dollar.

Should I invest in Cryptocurrency Mining?

For an individual miner, with a mining device, this is probably not a profitable option, as the risk–reward ratio is quite unbalanced.

Currently, most mining activities are entrusted to professional operators such as mining pools, whose members “pool” their computing resources for the mining process.

In a mining pool, the probability of finding a block is much higher, and if the process is successful, the profits are distributed among the members. This arrangement is a good option as it reduces the workload for all participants and increases the chances of success.

Are there any Disadvantages associated with Crypto Mining?

The mining price

Perhaps the most significant drawback of cryptocurrency mining is its high cost. As a miner, you will have to shell out funds for equipment, electricity costs, and maintenance and storage costs if you own a mining farm. Moreover, it is not enough to have expensive equipment. You also need to know how to operate and maintain it.

Power Consumption

A frequently mentioned disadvantage is the amount of electricity required for the extraction process. This increases the fees again, as the investor will have to foot the bill. The high power consumption is not really environmentally friendly and could put off traders who want to mine in more energy-efficient cryptocurrencies.

The Mining pool

If you are considering getting into this business, you will need to have a thorough knowledge of the process and sufficient funds to get off to a good start. A great way to profit from mining is to join a mining pool.

However, there are a few basics you need to get started.

Crypto Wallet

The cryptocurrency wallet is probably the easiest to get, and you’ll need it to store the cryptocurrencies you earn while mining. There are various digital wallets, with or without deposit, and even cold storage wallets such as those offered by Ledger and Trezor, which store virtual tokens offline.

Mining Software

Mining software works with your equipment to help you monitor its operation and ensure your mining is running smoothly. There is a lot of free software for various operating systems (or others that cost up to $250). Out of the best mining software, new users are better off opting for cloud-based software, especially if they have low withdrawal requirements. On the other hand, there is advanced software, which can be adapted according to individual needs.

Mining Equipment

As Cryptopedia states, there is a whole range of different platforms to choose from depending on your needs (ASIC, GPU, CPU, FPGA, and cloud mining) which vary in rewards and computing power. Hardware can be expensive. The choice should be made depending on needs and resources.

To avoid buying and maintaining expensive equipment, anyone interested in mining can sign a contract with a mining contractor.

Tips for joining a mining pool

Here are some things to keep in mind when choosing it:

- Pool size: A larger pool means smaller but more frequent payouts, more hash power, and more blocks. A pool with fewer participants will not find as many blocks and will have a longer waiting period. However, the gains will be distributed among a small group and therefore the benefits will be greater.

- Fees: Some mining pools have membership fees; the owner deducts fees from payments, usually around 4% or less.

- Safety: Try to join a well-established and reputable mining pool.

Is cryptocurrency mining more profitable than cryptocurrency trading?

Unfortunately, there is no clear answer, as different configurations may meet different expectations.

Cryptocurrency trading is much more accessible and a good starting point for beginners. Although crypto trading can be a volatile business, things like automated crypto trading can help traders mitigate risk. If you want to make quick profits on digital tokens despite the risk, this can be the perfect solution.

On the other hand, cryptocurrency mining requires a big commitment upfront: expensive hardware, moderately priced software, and higher levels of expertise and resilience.

Conclusion

In the end, what matters are your goals and the resources you have. Both crypto trading and crypto mining are important parts of the crypto ecosystem. Both can certainly be viable and profitable options for individual traders.

As always, do your own research and never risk more than you can afford to lose.

Do you want to know more? Explore our other Cryptocurrency articles

Shall you want to explore your banking options related to cryptocurrency- do not hesitate to book a free consultation with our friendly team.

Disclaimer

Widelia and its affiliates do not provide tax, investment, legal or accounting advice. Material on this page has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, investment, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Please consult https://widelia.com/disclaimer/ for more information.